Access credit lines £50k to £5M

Repay within 150 days

Zero upfront costs

No commitment fees

Built for global businesses that want to move fast

From funding exciting opportunities to buying new stock and managing your cash flows – the only fInancing option you need to meet your global ambitions.

Flexible

Get funded quickly and repay anytime within 150 days.

Unsecured

No specific collateral is needed. Your goods remain yours.

Transparent

No upfront costs or hidden fees. Pay only for what you use.

Efficient

Pay your supplier in their currency and repay in yours to manage FX fluctuations.

Efficient

Pay your supplier in their currency and repay in yours to manage FX fluctuations.

Who can apply

To date, we’ve financed £1BN+ amount to help businesses access funds. We're excited to help you realise your goals if you have:

Annual revenue > £1M

Net worth > £100,000

2+ years of trading history

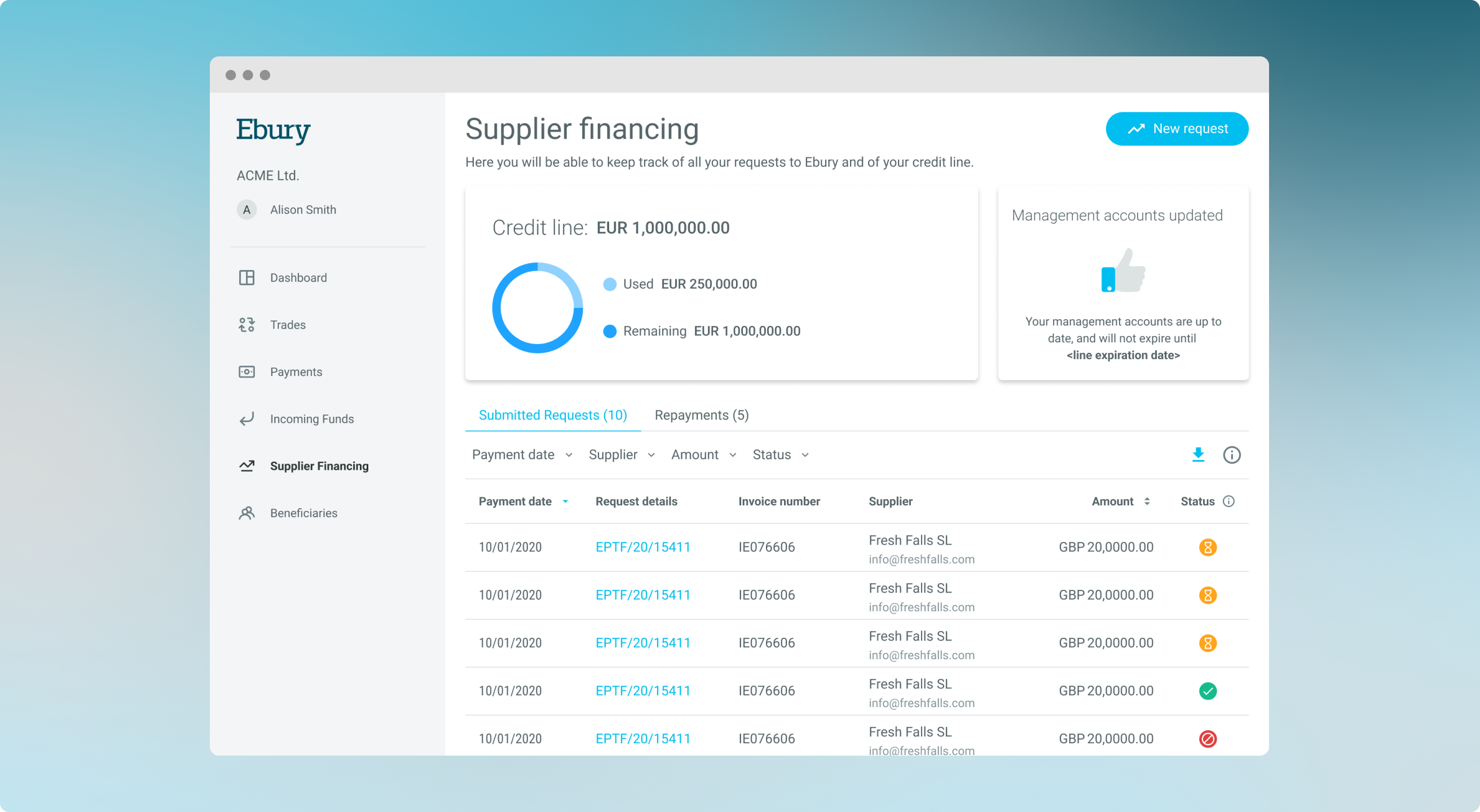

Bridge your working capital gap in four easy steps

Step 1: Connect

Get in touch with our team, who will create a bespoke funding and payment solution for you.

Step 2: Get funded

Once you complete the process, send invoices from your suppliers to Ebury.

Step 3: Scale

Ebury can pay your suppliers in 130+ currencies, so you can negotiate better pricing.

Step 4: Repay

Sell your goods and repay Ebury within 150 days.

Why choose Ebury?

No commitment. All-in-one dashboard. Transparent process.

Designed to turn your business goals into reality.

Ebury Trade Financing

Loans from traditional providers

Got a question? We are here to help you.

If you can’t find answers to your questions, our team would be more than happy to assist you.

If the annual revenue of your business is more than £1M, has a tangible net worth of £100,000, and displays a healthy trading record for at least two years – you can apply for our lending solution.

We do not take the title over your goods or any security against you or the business. In rare cases, we may require a personal or cross-company guarantee to provide financing.

We require the following documents to assess your business – two years of full accounts, monthly (or quarterly) management accounts for the past 12 months and a list of aged debtors and creditors. We also require financial monitoring on an ongoing basis to further use the line.

Once you have submitted all the required information, the process can take up to two weeks, but we always strive to expedite the process.

Interest is quoted per-30-day basis and applied daily following a minimum 30-day period. For example, if you use £100,000 of financing at 1% per 30 days and repay after 150 days, you will repay £105,000. If you repay after 60 days, you will repay £102,000.