Euro struggles as meltdown in Ukraine talks drives flight to safety

A rather anodyne week in currency trading ended in a dollar buying frenzy on Friday.

FX Market Updates

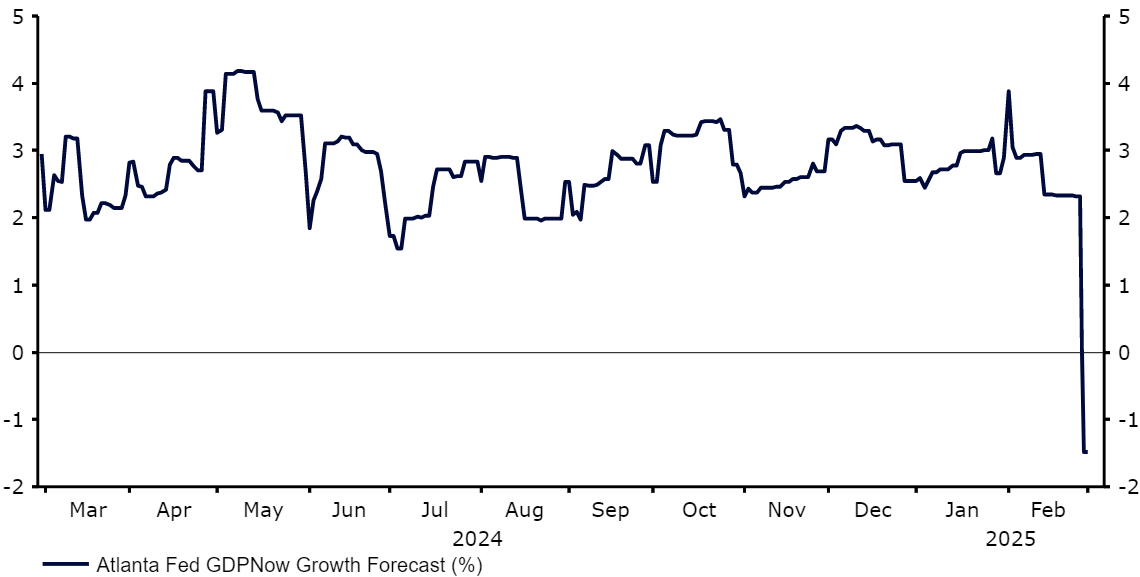

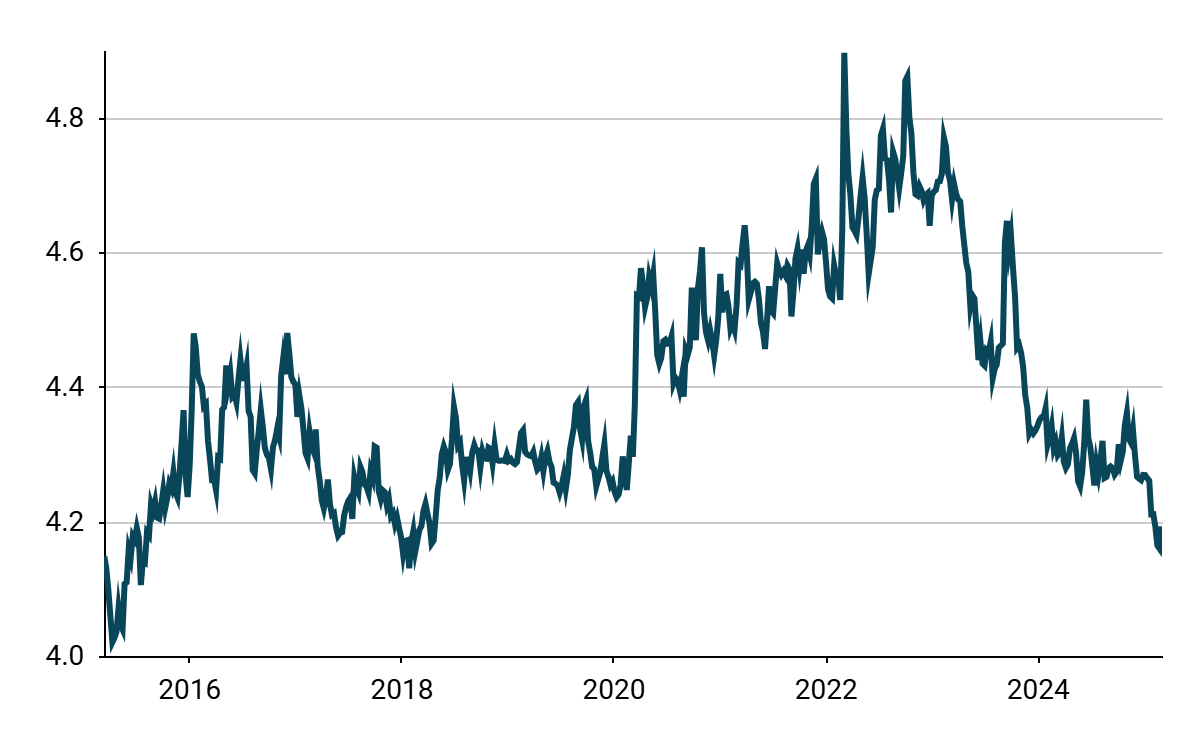

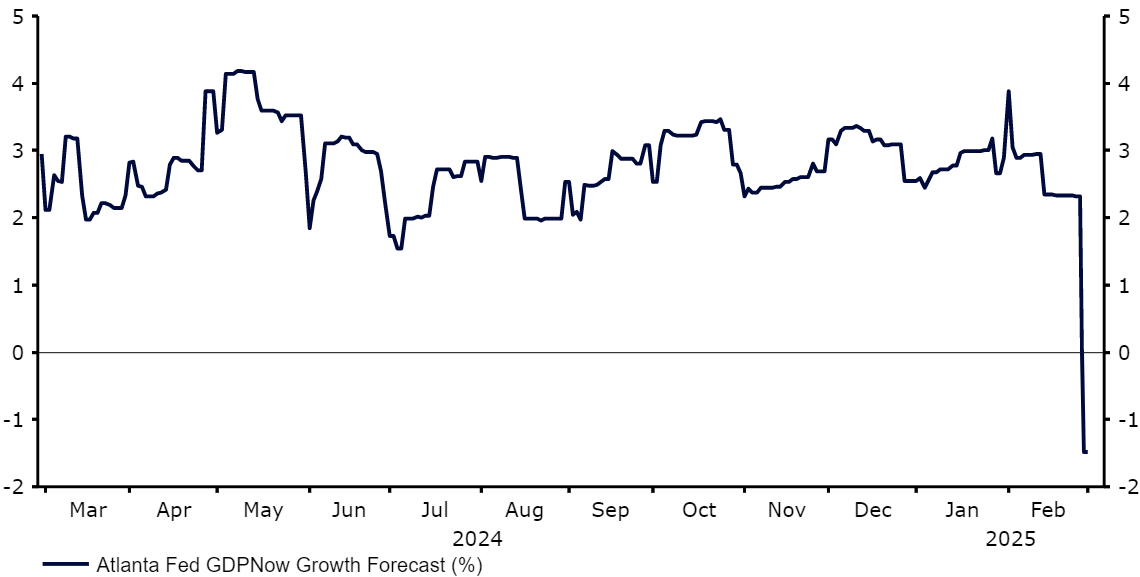

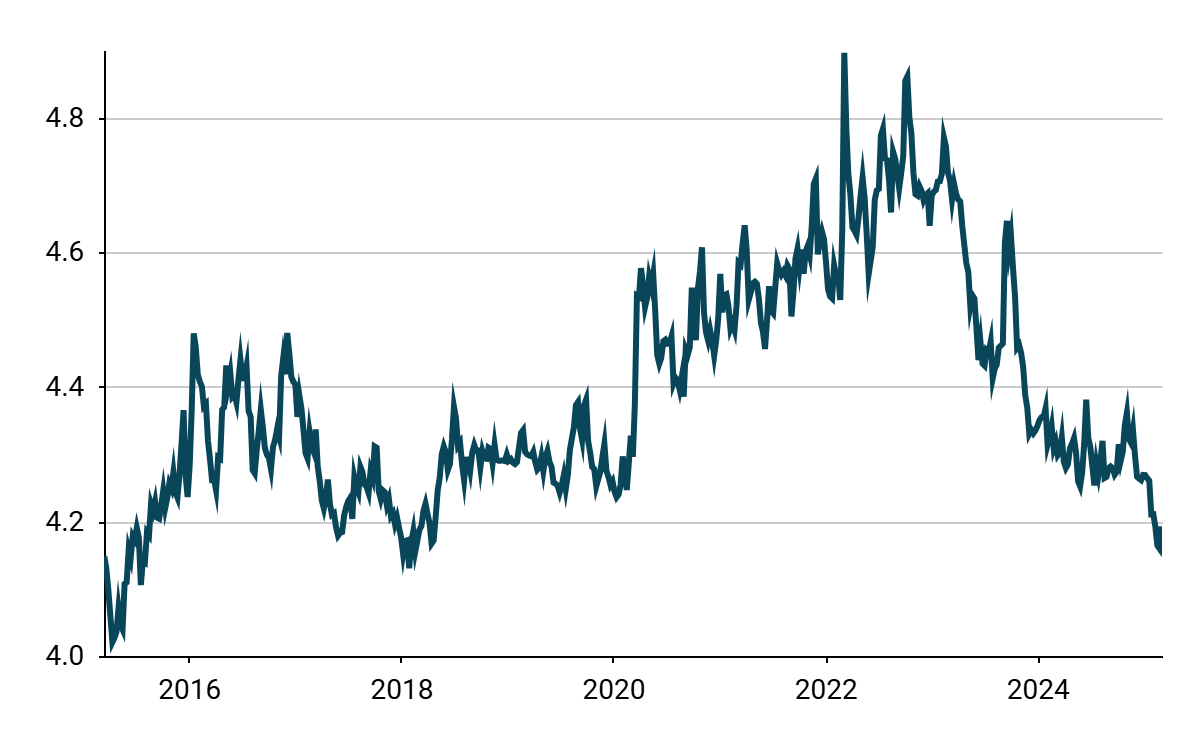

A rather anodyne week in currency trading ended in a dollar buying frenzy on Friday.Investors reacted to the shocking sight of open bickering and bellowing at what was supposed to be a photo op in the Oval Office of the White House. The spectacle threw into doubt not only the Ukraine agreement, but more generally the entire post-war architecture and the US commitment to worldwide security under Trump. There was a surprising split in markets, in that US stocks managed to rally towards the end of the Friday session, even as currency investors fled to the safe-havens, which included the Swiss franc and the Japanese yen. The key for this week will be to see how this dichotomy is resolved.This week promises to be a very volatile one. In addition to the aftershocks to the disaster in the White House, Trump has stated that tariffs on Canada and Mexico will go into effect on Tuesday, although markets appear to be bracing for the possibility of eleventh hour deals. Eurozone inflation figures on Monday, then the ECB meeting on Thursday and the January US payrolls report on Friday, will also be key. Ordinarily, we would focus mostly on the latter, to see if it confirms the signs of weakness in the US economy. Political headlines are likely to be as market moving in the current environment, however.USDCracks are starting to appear in some of the high-frequency indicators of the US economy. Weekly jobless claims rose to the highest level in 2025 so far, although they remain low by historical standards. Consumer spending actually contracted in January. Finally, the trade deficit increased massively at the beginning of the year, as companies built up stock ahead of the incoming tariffs. Arithmetically, this implies lower GDP, and the Atlanta Fed GDPNow estimate, which provides a running gauge of US GDP growth, is now pointing to a shock annualised contraction in the first quarter of the year.This week's nonfarm payrolls report (Friday) should validate or dispel these fears. Markets are expecting no meaningful slowdown in the report, so the dollar may be vulnerable to a negative surprise here. In the meantime, the latest services PMI data from both S&P and ISM (Wednesday) will also be closely watched, with investors to be on the lookout for signs that things may not be quite as bad as currently feared.Figure 1: US Atlanta Fed GDPNow Estimate (1 year) Source: LSEG Datastream Date: 03/03/2025EURThe gap that developed last year between the economic performance of the Eurozone and that in the US seems to be closing. On balance, Eurozone data continues to come in stronger than expected, admittedly this isn't saying much, while US economic releases have largely surprised to the downside in the last couple of weeks. This mattered little last week as markets focused on the apparent unravelling of the mutual security system that has bound Europe and the US since 1945, and sent the common currency lower. We are confident that cool heads will prevail, but clearly the chances of a ceasefire have taken a hit in recent days.The European Central Bank’s March meeting now looms. Another 25 basis point rate cut is all but certain, and the main unknown is how much further will the central bank be willing to lower rates given stubbornly high inflation. The threat of EU tariffs also continues to loom large. Trump again warned last week that these were imminent, but he has yet to provide any clear details of these restrictions, other than to issue a number of rather vague threats. GBPThe UK seems to be developing into something of a safe haven amid the geopolitical storm. The meeting between Prime Minister Keir Starmer and President Trump went as well as anyone could have hoped, and the possibility of a trade agreement between the US and UK, which would avoid the imposition of trade restrictions, was floated. At any rate, Britain runs a trade deficit with the US, and has very limited dependence on external demand, so its exposure to tariffs is not at all massive.Bank of England officials are also sounding more hawkish as inflation fails to ease further. MPC member Ramsden raised fresh concerns over the impact of another acceleration in wages on consumer prices, explicitly saying that this could slow the pace of UK rate cuts. Indeed, swap markets are now barely pricing in two additional rate reductions during the remainder of 2025, which seems reasonable to us. The net result is that sterling rode the dollar-buying storm rather well, and it outperformed every other major currency last week. RONThe past week did not bring many significant macroeconomic news from the country. Recent information, however, does not inspire much optimism. Economic growth is experiencing some revival, though less dynamic than previously expected. Inflation remains at higher-than-expected levels, and there is little indication that it will decrease significantly in the near future. This should keep interest rates high for a longer period, which may negatively impact consumer demand.Declines are already visible in retail sales data, which have decreased from local highs in recent months. The upcoming Thursday will bring new data, which may confirm this trend. Yet, despite some deterioration, the indicator still remains at very healthy levels, standing at 7.8%. PLNLast week brought significant turbulence for the zloty. On Thursday, the EUR/PLN pair fell below the 4.13 level, crossing another local minimum. Thus, it found itself at its lowest level since July 2015. As soon as Friday, however, the exchange rate bounced up to the 4.20 level, which emphatically shows how volatile and unpredictable the currency market can be - even in a horizon as short as a day or two. It is worth noting that Friday's weakening was the currency's strongest 1-day move since November and the zloty was the region's worst-performing currency last week.Although in the geopolitical context, it is difficult to put it that way, from our point of view it somewhat normalises the situation of the Polish currency, as the continued appreciation of the zloty was rather dubious.Figure 2: EUR/PLN (2015 - 2025)

Source: LSEG Datastream Date: 03/03/2025EURThe gap that developed last year between the economic performance of the Eurozone and that in the US seems to be closing. On balance, Eurozone data continues to come in stronger than expected, admittedly this isn't saying much, while US economic releases have largely surprised to the downside in the last couple of weeks. This mattered little last week as markets focused on the apparent unravelling of the mutual security system that has bound Europe and the US since 1945, and sent the common currency lower. We are confident that cool heads will prevail, but clearly the chances of a ceasefire have taken a hit in recent days.The European Central Bank’s March meeting now looms. Another 25 basis point rate cut is all but certain, and the main unknown is how much further will the central bank be willing to lower rates given stubbornly high inflation. The threat of EU tariffs also continues to loom large. Trump again warned last week that these were imminent, but he has yet to provide any clear details of these restrictions, other than to issue a number of rather vague threats. GBPThe UK seems to be developing into something of a safe haven amid the geopolitical storm. The meeting between Prime Minister Keir Starmer and President Trump went as well as anyone could have hoped, and the possibility of a trade agreement between the US and UK, which would avoid the imposition of trade restrictions, was floated. At any rate, Britain runs a trade deficit with the US, and has very limited dependence on external demand, so its exposure to tariffs is not at all massive.Bank of England officials are also sounding more hawkish as inflation fails to ease further. MPC member Ramsden raised fresh concerns over the impact of another acceleration in wages on consumer prices, explicitly saying that this could slow the pace of UK rate cuts. Indeed, swap markets are now barely pricing in two additional rate reductions during the remainder of 2025, which seems reasonable to us. The net result is that sterling rode the dollar-buying storm rather well, and it outperformed every other major currency last week. RONThe past week did not bring many significant macroeconomic news from the country. Recent information, however, does not inspire much optimism. Economic growth is experiencing some revival, though less dynamic than previously expected. Inflation remains at higher-than-expected levels, and there is little indication that it will decrease significantly in the near future. This should keep interest rates high for a longer period, which may negatively impact consumer demand.Declines are already visible in retail sales data, which have decreased from local highs in recent months. The upcoming Thursday will bring new data, which may confirm this trend. Yet, despite some deterioration, the indicator still remains at very healthy levels, standing at 7.8%. PLNLast week brought significant turbulence for the zloty. On Thursday, the EUR/PLN pair fell below the 4.13 level, crossing another local minimum. Thus, it found itself at its lowest level since July 2015. As soon as Friday, however, the exchange rate bounced up to the 4.20 level, which emphatically shows how volatile and unpredictable the currency market can be - even in a horizon as short as a day or two. It is worth noting that Friday's weakening was the currency's strongest 1-day move since November and the zloty was the region's worst-performing currency last week.Although in the geopolitical context, it is difficult to put it that way, from our point of view it somewhat normalises the situation of the Polish currency, as the continued appreciation of the zloty was rather dubious.Figure 2: EUR/PLN (2015 - 2025) Source: Bloomberg, 04/03/2025News from the extraordinary summit of European leaders on Ukraine on 6 March may be of significance for the zloty. This week, however, there will also be no shortage of other, more standard information that may move the exchange rate of the Polish currency, with attention mainly directed outwards.HUFThe Hungarian currency finished last week at the top of the regional performance tracker, although it should be stressed that the differences were rather marginal. Another pause was made by the MNB, with wage growth, a key pro-inflationary factor at the moment, placing above expectations (11.3%). Recall that inflation remains a major concern in Hungary, with January bringing the highest readings in a year for both headline (5.5%) and core (5.8%) measures. In view of the above, a rate cut any time soon seems rather unlikely to us. This may offer the currency some support in the medium term.Figure 3: Hungary CPI Inflation & Wage Growth [YoY, NSA] (2020 - 2025)Source: KSH via Bloomberg, 04/03/2025As in the Czech Republic, Hungary's manufacturing PMI improved (51, a nine-month high). Later in the week, attention will turn to the main hard macroeconomic indicators for January - retail sales and industrial production (Thursday). We expect, however, that volatility will largely depend on events overseas.

Source: Bloomberg, 04/03/2025News from the extraordinary summit of European leaders on Ukraine on 6 March may be of significance for the zloty. This week, however, there will also be no shortage of other, more standard information that may move the exchange rate of the Polish currency, with attention mainly directed outwards.HUFThe Hungarian currency finished last week at the top of the regional performance tracker, although it should be stressed that the differences were rather marginal. Another pause was made by the MNB, with wage growth, a key pro-inflationary factor at the moment, placing above expectations (11.3%). Recall that inflation remains a major concern in Hungary, with January bringing the highest readings in a year for both headline (5.5%) and core (5.8%) measures. In view of the above, a rate cut any time soon seems rather unlikely to us. This may offer the currency some support in the medium term.Figure 3: Hungary CPI Inflation & Wage Growth [YoY, NSA] (2020 - 2025)Source: KSH via Bloomberg, 04/03/2025As in the Czech Republic, Hungary's manufacturing PMI improved (51, a nine-month high). Later in the week, attention will turn to the main hard macroeconomic indicators for January - retail sales and industrial production (Thursday). We expect, however, that volatility will largely depend on events overseas.

Source: LSEG Datastream Date: 03/03/2025EURThe gap that developed last year between the economic performance of the Eurozone and that in the US seems to be closing. On balance, Eurozone data continues to come in stronger than expected, admittedly this isn't saying much, while US economic releases have largely surprised to the downside in the last couple of weeks. This mattered little last week as markets focused on the apparent unravelling of the mutual security system that has bound Europe and the US since 1945, and sent the common currency lower. We are confident that cool heads will prevail, but clearly the chances of a ceasefire have taken a hit in recent days.The European Central Bank’s March meeting now looms. Another 25 basis point rate cut is all but certain, and the main unknown is how much further will the central bank be willing to lower rates given stubbornly high inflation. The threat of EU tariffs also continues to loom large. Trump again warned last week that these were imminent, but he has yet to provide any clear details of these restrictions, other than to issue a number of rather vague threats. GBPThe UK seems to be developing into something of a safe haven amid the geopolitical storm. The meeting between Prime Minister Keir Starmer and President Trump went as well as anyone could have hoped, and the possibility of a trade agreement between the US and UK, which would avoid the imposition of trade restrictions, was floated. At any rate, Britain runs a trade deficit with the US, and has very limited dependence on external demand, so its exposure to tariffs is not at all massive.Bank of England officials are also sounding more hawkish as inflation fails to ease further. MPC member Ramsden raised fresh concerns over the impact of another acceleration in wages on consumer prices, explicitly saying that this could slow the pace of UK rate cuts. Indeed, swap markets are now barely pricing in two additional rate reductions during the remainder of 2025, which seems reasonable to us. The net result is that sterling rode the dollar-buying storm rather well, and it outperformed every other major currency last week. RONThe past week did not bring many significant macroeconomic news from the country. Recent information, however, does not inspire much optimism. Economic growth is experiencing some revival, though less dynamic than previously expected. Inflation remains at higher-than-expected levels, and there is little indication that it will decrease significantly in the near future. This should keep interest rates high for a longer period, which may negatively impact consumer demand.Declines are already visible in retail sales data, which have decreased from local highs in recent months. The upcoming Thursday will bring new data, which may confirm this trend. Yet, despite some deterioration, the indicator still remains at very healthy levels, standing at 7.8%. PLNLast week brought significant turbulence for the zloty. On Thursday, the EUR/PLN pair fell below the 4.13 level, crossing another local minimum. Thus, it found itself at its lowest level since July 2015. As soon as Friday, however, the exchange rate bounced up to the 4.20 level, which emphatically shows how volatile and unpredictable the currency market can be - even in a horizon as short as a day or two. It is worth noting that Friday's weakening was the currency's strongest 1-day move since November and the zloty was the region's worst-performing currency last week.Although in the geopolitical context, it is difficult to put it that way, from our point of view it somewhat normalises the situation of the Polish currency, as the continued appreciation of the zloty was rather dubious.Figure 2: EUR/PLN (2015 - 2025)

Source: LSEG Datastream Date: 03/03/2025EURThe gap that developed last year between the economic performance of the Eurozone and that in the US seems to be closing. On balance, Eurozone data continues to come in stronger than expected, admittedly this isn't saying much, while US economic releases have largely surprised to the downside in the last couple of weeks. This mattered little last week as markets focused on the apparent unravelling of the mutual security system that has bound Europe and the US since 1945, and sent the common currency lower. We are confident that cool heads will prevail, but clearly the chances of a ceasefire have taken a hit in recent days.The European Central Bank’s March meeting now looms. Another 25 basis point rate cut is all but certain, and the main unknown is how much further will the central bank be willing to lower rates given stubbornly high inflation. The threat of EU tariffs also continues to loom large. Trump again warned last week that these were imminent, but he has yet to provide any clear details of these restrictions, other than to issue a number of rather vague threats. GBPThe UK seems to be developing into something of a safe haven amid the geopolitical storm. The meeting between Prime Minister Keir Starmer and President Trump went as well as anyone could have hoped, and the possibility of a trade agreement between the US and UK, which would avoid the imposition of trade restrictions, was floated. At any rate, Britain runs a trade deficit with the US, and has very limited dependence on external demand, so its exposure to tariffs is not at all massive.Bank of England officials are also sounding more hawkish as inflation fails to ease further. MPC member Ramsden raised fresh concerns over the impact of another acceleration in wages on consumer prices, explicitly saying that this could slow the pace of UK rate cuts. Indeed, swap markets are now barely pricing in two additional rate reductions during the remainder of 2025, which seems reasonable to us. The net result is that sterling rode the dollar-buying storm rather well, and it outperformed every other major currency last week. RONThe past week did not bring many significant macroeconomic news from the country. Recent information, however, does not inspire much optimism. Economic growth is experiencing some revival, though less dynamic than previously expected. Inflation remains at higher-than-expected levels, and there is little indication that it will decrease significantly in the near future. This should keep interest rates high for a longer period, which may negatively impact consumer demand.Declines are already visible in retail sales data, which have decreased from local highs in recent months. The upcoming Thursday will bring new data, which may confirm this trend. Yet, despite some deterioration, the indicator still remains at very healthy levels, standing at 7.8%. PLNLast week brought significant turbulence for the zloty. On Thursday, the EUR/PLN pair fell below the 4.13 level, crossing another local minimum. Thus, it found itself at its lowest level since July 2015. As soon as Friday, however, the exchange rate bounced up to the 4.20 level, which emphatically shows how volatile and unpredictable the currency market can be - even in a horizon as short as a day or two. It is worth noting that Friday's weakening was the currency's strongest 1-day move since November and the zloty was the region's worst-performing currency last week.Although in the geopolitical context, it is difficult to put it that way, from our point of view it somewhat normalises the situation of the Polish currency, as the continued appreciation of the zloty was rather dubious.Figure 2: EUR/PLN (2015 - 2025) Source: Bloomberg, 04/03/2025News from the extraordinary summit of European leaders on Ukraine on 6 March may be of significance for the zloty. This week, however, there will also be no shortage of other, more standard information that may move the exchange rate of the Polish currency, with attention mainly directed outwards.HUFThe Hungarian currency finished last week at the top of the regional performance tracker, although it should be stressed that the differences were rather marginal. Another pause was made by the MNB, with wage growth, a key pro-inflationary factor at the moment, placing above expectations (11.3%). Recall that inflation remains a major concern in Hungary, with January bringing the highest readings in a year for both headline (5.5%) and core (5.8%) measures. In view of the above, a rate cut any time soon seems rather unlikely to us. This may offer the currency some support in the medium term.Figure 3: Hungary CPI Inflation & Wage Growth [YoY, NSA] (2020 - 2025)Source: KSH via Bloomberg, 04/03/2025As in the Czech Republic, Hungary's manufacturing PMI improved (51, a nine-month high). Later in the week, attention will turn to the main hard macroeconomic indicators for January - retail sales and industrial production (Thursday). We expect, however, that volatility will largely depend on events overseas.

Source: Bloomberg, 04/03/2025News from the extraordinary summit of European leaders on Ukraine on 6 March may be of significance for the zloty. This week, however, there will also be no shortage of other, more standard information that may move the exchange rate of the Polish currency, with attention mainly directed outwards.HUFThe Hungarian currency finished last week at the top of the regional performance tracker, although it should be stressed that the differences were rather marginal. Another pause was made by the MNB, with wage growth, a key pro-inflationary factor at the moment, placing above expectations (11.3%). Recall that inflation remains a major concern in Hungary, with January bringing the highest readings in a year for both headline (5.5%) and core (5.8%) measures. In view of the above, a rate cut any time soon seems rather unlikely to us. This may offer the currency some support in the medium term.Figure 3: Hungary CPI Inflation & Wage Growth [YoY, NSA] (2020 - 2025)Source: KSH via Bloomberg, 04/03/2025As in the Czech Republic, Hungary's manufacturing PMI improved (51, a nine-month high). Later in the week, attention will turn to the main hard macroeconomic indicators for January - retail sales and industrial production (Thursday). We expect, however, that volatility will largely depend on events overseas.