ECB hawkishness fails to rescue euro as Russian invasion continues to drive markets

The ECB's unambiguously hawkish messaging last week did not stop the euro from sinking to new lows as concerns mount over stagflation or worse.

FX Market Updates

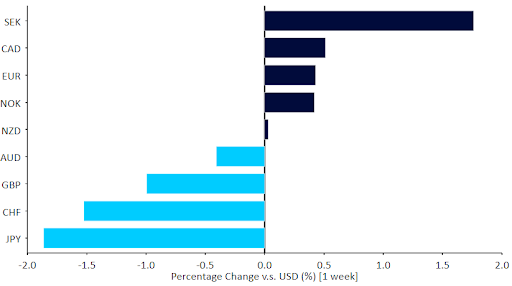

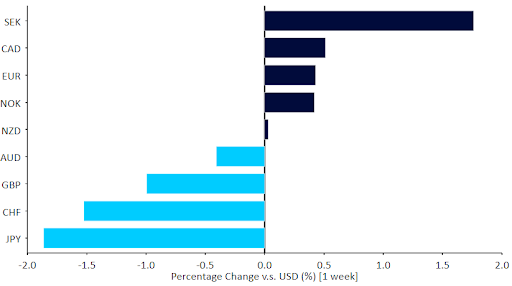

The ECB's unambiguously hawkish messaging last week did not stop the euro from sinking to new lows as concerns mount over stagflation or worse.We also saw a significant rebound in Eastern European currencies led by the Polish zloty, as central banks in the region both raised interest rates aggressively and/or intervened directly in the market in order to prop up their currencies. We also saw continuing rallies in commodity currencies far away from the war, such as our long standing favourite, the Brazilian real.Economic news will continue to take a back seat to the newsflow from the war on one hand, and the reaction to the fresh supply shock from the world's major central banks on the other. This week will be the Federal Reserve’s turn. Market expectations for a 25 basis point hike look correct to us, and we also expect an unambiguously hawkish message as the Fed has fallen severely behind the curve. We expect more or less the same outcome from the Bank of England meeting the following day.Figure 1: G10 FX Performance Tracker (1 week)

This should be helped along by the Bank of England meeting on Thursday. We expect the MPC to hike interest rates again and join the Fed and ECB in pivoting communications towards an increased focus in taming surging inflation amid the fresh supply shocks. With a 25 basis point move fully priced in by markets, the reaction in the pound will be driven largely by the voting patterns, and communications on both inflation and future rate increases.

This should be helped along by the Bank of England meeting on Thursday. We expect the MPC to hike interest rates again and join the Fed and ECB in pivoting communications towards an increased focus in taming surging inflation amid the fresh supply shocks. With a 25 basis point move fully priced in by markets, the reaction in the pound will be driven largely by the voting patterns, and communications on both inflation and future rate increases. The macroeconomic calendar is light this week, aside of course from the critical FOMC meeting. In principle, the hawkish communications we expect should be positive for the dollar, but the failure of the euro to rally last week suggests that this correlation may have weakened in the wake of the invasion. With a 25 basis point hike fully priced in, we will be paying particularly close attention to the bank’s updated interest rate projections - the ‘dot plot’. We think that a sizable upward revision here is likely in light of the inflation ramifications of the Russia-Ukraine war.

The macroeconomic calendar is light this week, aside of course from the critical FOMC meeting. In principle, the hawkish communications we expect should be positive for the dollar, but the failure of the euro to rally last week suggests that this correlation may have weakened in the wake of the invasion. With a 25 basis point hike fully priced in, we will be paying particularly close attention to the bank’s updated interest rate projections - the ‘dot plot’. We think that a sizable upward revision here is likely in light of the inflation ramifications of the Russia-Ukraine war.

GBP

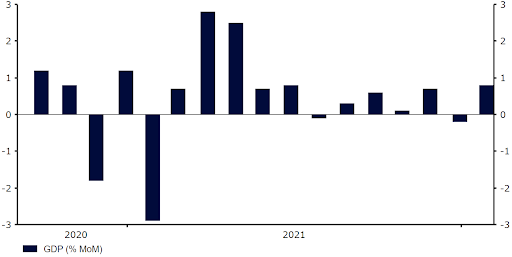

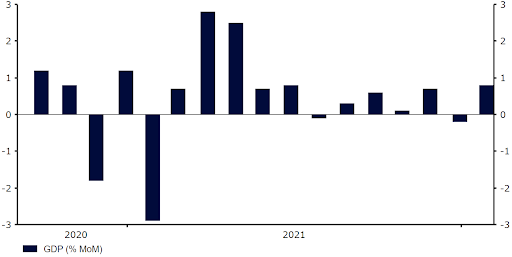

Very strong monthly GDP data out of the UK confirms that the economy was very strong prior to the war shock. Sterling, however, did not benefit, ending the week near the bottom of the G10 rankings. We are a bit puzzled by the move lower - we think the currency is oversold, and see scope for a rebound.Figure 2: UK GDP [monthly] (2020 - 2022) This should be helped along by the Bank of England meeting on Thursday. We expect the MPC to hike interest rates again and join the Fed and ECB in pivoting communications towards an increased focus in taming surging inflation amid the fresh supply shocks. With a 25 basis point move fully priced in by markets, the reaction in the pound will be driven largely by the voting patterns, and communications on both inflation and future rate increases.

This should be helped along by the Bank of England meeting on Thursday. We expect the MPC to hike interest rates again and join the Fed and ECB in pivoting communications towards an increased focus in taming surging inflation amid the fresh supply shocks. With a 25 basis point move fully priced in by markets, the reaction in the pound will be driven largely by the voting patterns, and communications on both inflation and future rate increases.EUR

The ECB seems to have finally pivoted to restoring its inflation credibility, but for now markets remain focused on the war threat to the European economy and the euro seems unable to hold above the 1.10 level versus the dollar. This is for now a common struggle to all European currencies, but we think that any significant positive news from the war could lead to a rebound of the oversold common currency.Meanwhile, a slate of ECB speakers are on tap for Thursday, which should add needed clarity to the ECB’s intended schedule for higher rates. We continue to see a first hike by at least the bank’s September meeting.USD

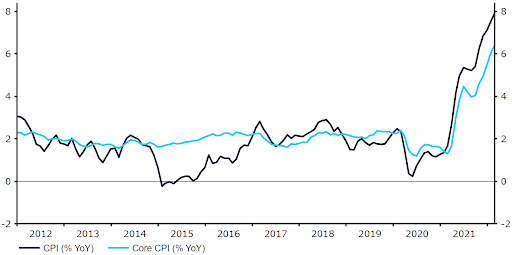

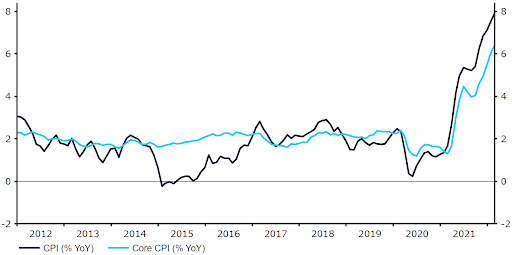

February inflation in the US rose to yet another multi-decade high of almost 8% but, for the first time in a while at least, it did not exceed market expectations. Nevertheless, core inflation also rose sharply, up to 6.4% and its highest level since August 1982.Figure 2: US Inflation Rate (2012 - 2022) The macroeconomic calendar is light this week, aside of course from the critical FOMC meeting. In principle, the hawkish communications we expect should be positive for the dollar, but the failure of the euro to rally last week suggests that this correlation may have weakened in the wake of the invasion. With a 25 basis point hike fully priced in, we will be paying particularly close attention to the bank’s updated interest rate projections - the ‘dot plot’. We think that a sizable upward revision here is likely in light of the inflation ramifications of the Russia-Ukraine war.

The macroeconomic calendar is light this week, aside of course from the critical FOMC meeting. In principle, the hawkish communications we expect should be positive for the dollar, but the failure of the euro to rally last week suggests that this correlation may have weakened in the wake of the invasion. With a 25 basis point hike fully priced in, we will be paying particularly close attention to the bank’s updated interest rate projections - the ‘dot plot’. We think that a sizable upward revision here is likely in light of the inflation ramifications of the Russia-Ukraine war.